capital gains tax budget news

Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one. Another 10 per cent of wealthy Canadians paid up to 15 per cent which is essentially the first income tax bracket for the federal government.

Budget Taxes Archives Page 2 Of 6 Jacquelin Maycumber

Tax enforcement Democrats are also eyeing tax compliance.

. The 2022 federal budget left some third rails of Canadian tax policy untouched. All of Advisorcas 2022 federal budget coverage in one place. Budget 2022 Direct Tax.

If you had purchased a 2 bhk in a suburb of Mumbai in the FY year 2005. Calculating how much you need to pay as long term capital gains tax is not very difficult. The Chancellor in his Budget today delivered welcome news to individuals facing a capital gains tax liability following the sale of UK residential property.

On top of this the administration is aiming to increase the long-term. AP Senate Democrats on Thursday released a 592 billion two-year budget plan that includes 357 million in new revenue from a tax on capital gains. Mayor Lori Lightfoot wont.

Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to. On May 28 th Bidens budget revealed plans to raise the marginal income tax rate up from 37 to 396. Capital Gains and the Kiddie Tax Under the New Tax Law.

Congressional Hearing on Economic Disparity August 10 2022. Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. January 27 2022 1244 PM IST.

Reforms to capital-gains taxes would raise 3225 billion over a decade according to a Treasury estimate. 9 hours agoPETALING JAYA Oct 8 Malaysia should not bring back the Goods and Services Tax GST or introduce Capital Gains Tax CGT at this point in time PKR deputy president. Those paying the kiddie tax are in for higher rates that kick in at lower levels but capital gains are still.

Surcharge reduced on Long Term Capital Gains. You owe capital gains taxes on the profit that you make whenever you sell an investment asset or. Capital gains tax is a tax on the profit when a person sells something which has increased in value.

To discuss Capital Gains Tax Capital Acquisitions tax and your business contact Mike Scanlan Senior Tax Manager on 01 6440100. By Naomi Jagoda - 072421 500 PM ET. President Joe Biden plans to propose nearly doubling the capital gains rate for high earners to 396 plus an additional 38 Affordable Care Act tax on investment income.

Surcharge on Long Term Capital Gains on any assets Short Term Capital Gain on equity. The surcharge on long-term capital. If you buy a listed bond then you pay long-term capital gains LTCG tax of 10 percent if you hold it for more than 12 months.

2 days agoCapital Gains. How much tax you pay depends on your level of income. The much more common way is through capital gains taxes.

But if you sell a. Fact Sheet How the Capital Gains Tax Supports Communities. Venture capital investors and startup founders are likely to benefit from a tax tweak announced in Budget 2022-23.

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

What Are Capital Gains Taxes And How Could They Be Reformed

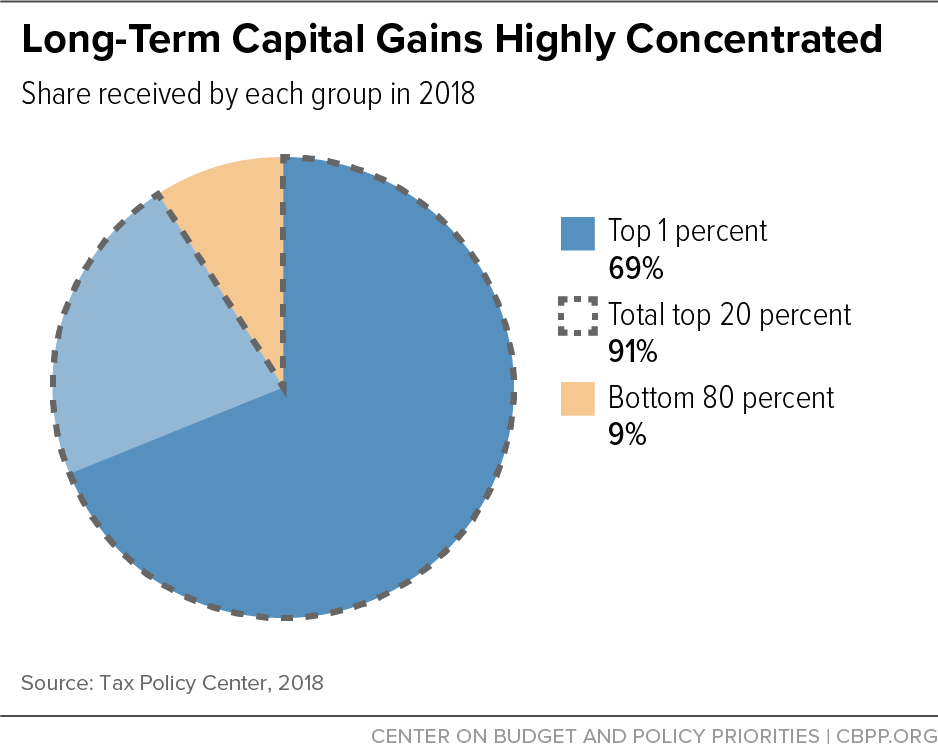

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Biden To Include Minimum Tax On Billionaires In Budget Proposal The New York Times

Capital Gains Tax Changes In 2021 Budget To Come Into Force Personal Finance Finance Express Co Uk

State Taxes On Capital Gains Center On Budget And Policy Priorities

Gov Inslee Renews Push For Capital Gains Tax In Proposed Budget Mynorthwest Com

Democrats Seek Backup Plan On Taxing Capital Gains Wsj

Biden S Capital Gains Tax Increase Is More Unproductive Misdirection The Hill

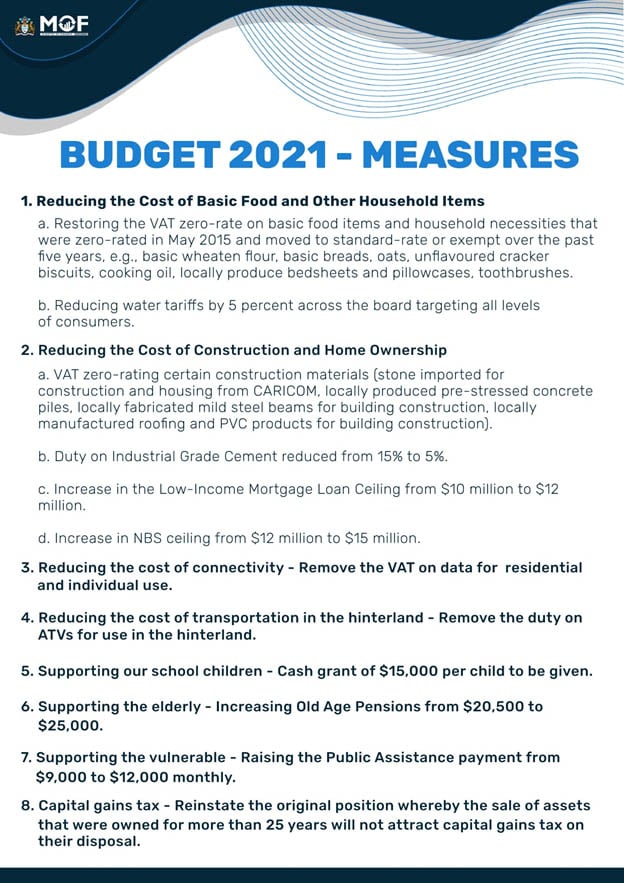

15 000 Per Child Cash Grant Old Age Pension Hike Among Proposed Budget Measures Stabroek News

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Big Tax Changes Are Brewing What You Need To Know Barron S

Capital Gains Full Report Tax Policy Center

United States Federal Budget Wikipedia

Budget Taxes Archives Page 4 Of 6 Peter Abbarno

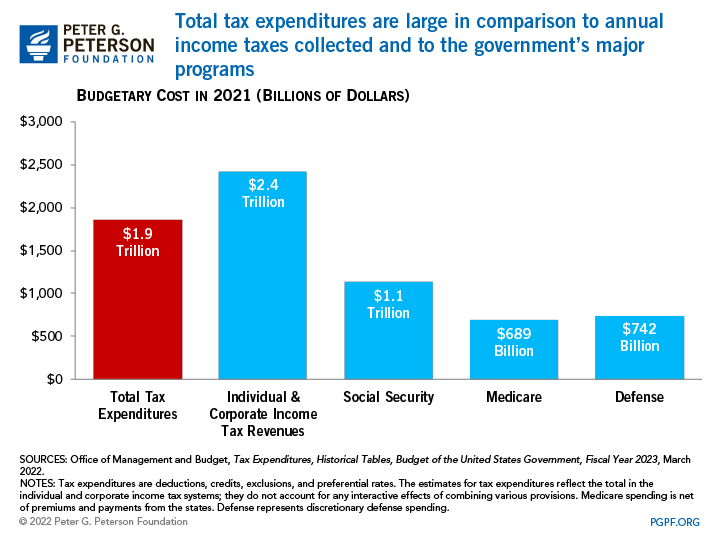

Understanding The Budget Revenues